Not that bad

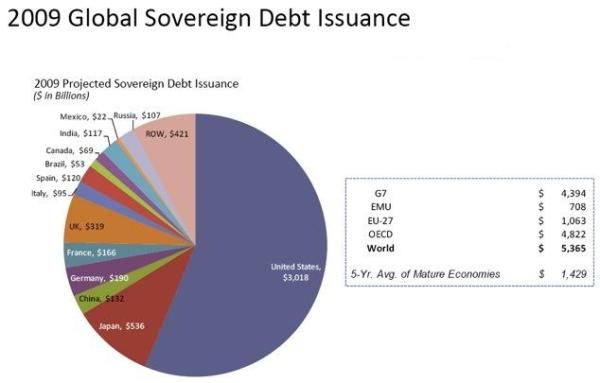

This chart, courtesy of the smart money guys (i.e., Inca Kola News) shows that while the rest of the world is in deep do-do (as the first President Bush was wont to say), the economic prospects for Mexico aren’t all that bad.

With the economic downturn, every country expects to go into debtnext year, but Mexico’s projected borrowing — a measly 22 billion U.S. dollars — is extremely modest for a major economic power (and — as we tend to forget — Mexico is the world’s 10th largest economy).

One thing PAN had going for it was that the country had almost no debt (in fact, the United States was indebted to Mexico, which is unusual), but — between the Wall Street crash, the lousy tourist season, the flu and increased military spending — and falling PEMEX revenues, sooner or later the country was going to have to borrow.

PAN won’t be controlling the national agenda with a new legislature, and even this minor amount of debt may not be necessary. PEMEX — having more money to plow back into exploration — is spending money on refinery upgrades. Additionally, as Oil Online reports, “Although Pemex is behind on its investment targets, the company has spent heavily on oil exploration and production this year.” Specifically, PEMEX has announced contracts for 500 new wells. That may not make sense if oil prices are dropping, but it will mean more domestic fuel sourcs (and less need to import refined gasoline) as well as more jobs… all of which will lessen the need for borrowed funding.

Also, one of the Calderon Administration’s few successes was changing the tax code to lessen dependence on PEMEX revenue for governmental operating expenses. The tax code has largely made up for the lost revenue, but the Administration — caught short by the financial downturn — is looking to cut spending. However, the Calderon Administration now a “lame duck presidency”, there is likely to be resistence to cuts in social spending.

Which, in itself, may not also cut into the need for foreign borrowing. The new legislature is likely to cut military spending, which unlike social programs, depends on foreign purchases. Social programs depend on internal resources (and create jobs, as well as increase the purchasing power of Mexican consumers), while military expenditures depend heavily on foreign purchases (Mexico produces some guns, trucks and uniforms — and even exports them — but the big ticket items like planes, tanks, and so on are purchased from abroad). Domestic programs might create some internal debt, but not a balance of trade problem.